Workers comp insurance is a critical safeguard for businesses and employees alike. This complete guide explains coverage, costs, benefits, laws, and how to choose the right policy.

What Is Workers Comp Insurance?

Workers comp insurance is a form of business insurance that provides financial and medical benefits to employees who are injured or become ill as a direct result of their job. It serves as a safety net for both employers and workers, ensuring injured employees receive proper care while protecting businesses from costly lawsuits.

This coverage is legally required in most states and industries, making workers comp insurance one of the most important policies an employer can carry. It supports workplace stability, promotes safer working environments, and ensures compliance with labor laws.

Definition and Purpose

At its core, workers comp insurance covers work-related injuries, illnesses, and fatalities. In exchange for guaranteed benefits, employees generally waive their right to sue their employer for negligence. This “no-fault” system benefits both parties by reducing legal conflicts and ensuring quick access to care.

Why Workers Comp Insurance Exists

Workplace injuries can be unpredictable and expensive. Without workers comp insurance, injured employees might face medical debt, while employers could be exposed to devastating lawsuits. This insurance creates a structured system that balances responsibility and protection on both sides.

How Workers Comp Insurance Works

Workers comp insurance follows a clear and regulated process designed to deliver timely support.

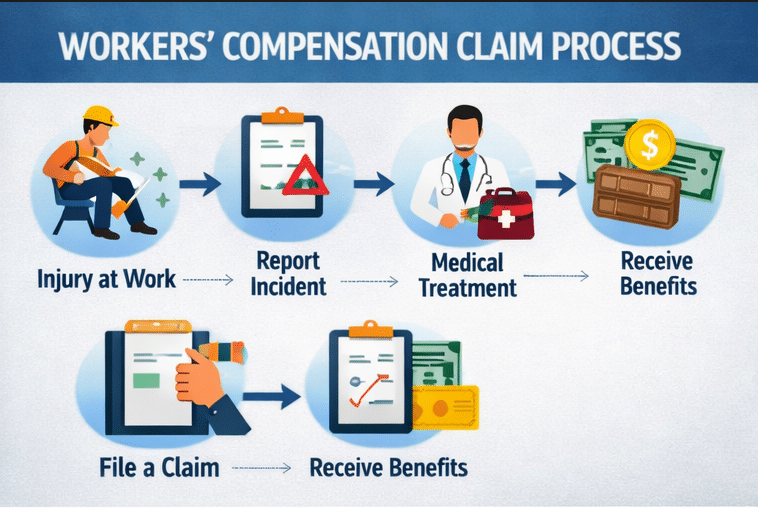

The Claims Process Step by Step

- Injury Occurs: An employee is injured or becomes ill at work.

- Incident Reported: The employee notifies the employer immediately.

- Medical Treatment: The employee receives approved medical care.

- Claim Filed: The employer submits a workers comp insurance claim.

- Claim Review: The insurer evaluates the claim.

- Benefits Paid: Approved claims result in medical and wage benefits.

Prompt reporting and documentation are essential to avoid delays or claim denials.

Employer vs Employee Responsibilities

- Employers must maintain coverage, provide claim forms, and ensure a safe workplace.

- Employees must report injuries promptly and follow treatment guidelines.

What Does Workers Comp Insurance Cover?

Workers comp insurance provides comprehensive benefits for job-related injuries and illnesses.

Medical Expenses

Coverage includes:

- Doctor visits

- Hospital stays

- Prescription medications

- Physical therapy

- Medical equipment

There are typically no out-of-pocket costs for employees.

Lost Wages and Disability Benefits

If an employee cannot work due to injury, workers comp insurance replaces a portion of lost wages. This may include:

- Temporary total disability

- Temporary partial disability

- Permanent disability benefits

Death and Survivor Benefits

In fatal workplace incidents, workers comp insurance provides funeral costs and financial support to surviving dependents.

What Is Not Covered by Workers Comp Insurance

Despite its broad protection, workers comp insurance does not cover:

- Injuries caused by intoxication

- Self-inflicted injuries

- Injuries outside the scope of employment

- Independent contractors (in most cases)

- Pain and suffering damages

Understanding exclusions helps employers and employees avoid misunderstandings.

Who Is Required to Carry Workers Comp Insurance?

Most employers are legally required to carry workers comp insurance, though rules vary by state.

State-Specific Legal Requirements

Each state sets its own requirements regarding:

- Minimum number of employees

- Industry exemptions

- Coverage limits

Failing to comply can result in severe penalties, fines, or business closure. You can review official guidelines through the U.S. Department of Labor:

👉 https://www.dol.gov/general/topic/workcomp

Exemptions and Special Cases

Common exemptions may include:

- Sole proprietors

- Family members

- Agricultural workers

- Independent contractors

However, misclassifying workers can lead to serious legal trouble.

How Much Does Workers Comp Insurance Cost?

The cost of workers comp insurance varies widely based on risk and payroll.

Factors That Affect Premiums

Key pricing factors include:

- Industry type

- Payroll size

- Employee job roles

- Claims history

- Location and state laws

High-risk industries naturally pay more.

Industry Risk Classifications

Each job is assigned a classification code. For example:

- Office workers = low risk

- Construction workers = high risk

Accurate classification is critical for fair pricing.

How to Reduce Workers Comp Insurance Costs

Employers can lower costs by:

- Improving workplace safety programs

- Offering employee training

- Implementing return-to-work programs

- Auditing payroll and classifications

- Maintaining a clean claims history

Prevention is often the most effective cost-control strategy.

Types of Workers Comp Insurance Policies

There are several ways to obtain workers comp insurance.

Private Insurance

Most businesses purchase coverage from private insurance carriers offering competitive pricing and services.

State-Funded Workers Comp Programs

Some states operate monopolistic or competitive state funds, which may be mandatory or optional.

Self-Insurance Options

Large companies with strong financial backing may self-insure, subject to strict regulatory approval.

Workers Comp Insurance for Small Businesses

Small businesses are often the most vulnerable to workplace injuries. Workers comp insurance:

- Protects limited cash flow

- Ensures legal compliance

- Builds employee trust

- Enhances business credibility

Even a single claim without coverage could threaten business survival.

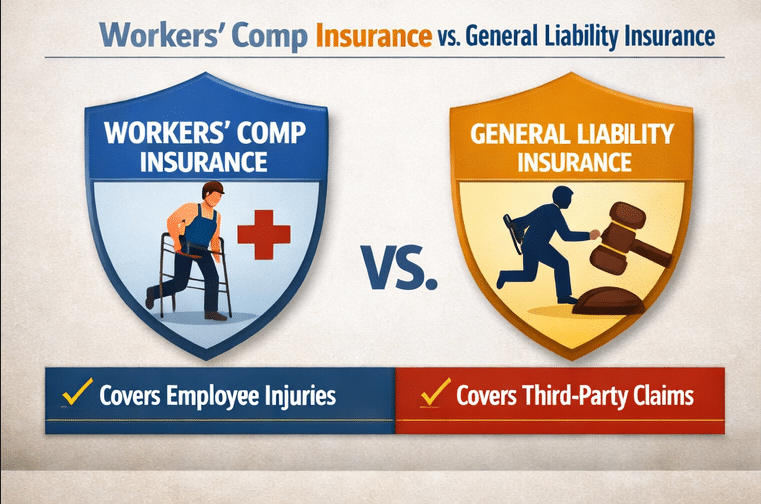

Workers Comp Insurance vs General Liability Insurance

| Feature | Workers Comp Insurance | General Liability Insurance |

|---|---|---|

| Covers employee injuries | ✅ Yes | ❌ No |

| Covers third-party claims | ❌ No | ✅ Yes |

| Required by law | ✅ Often | ❌ Usually optional |

| Covers medical bills | ✅ Yes | ❌ No |

Both policies are essential, but they serve different purposes.

Common Workers Comp Insurance Myths

- “Small businesses don’t need it.” False.

- “It covers all injuries.” False.

- “Claims always raise premiums.” Not always.

- “Independent contractors are covered.” Usually not.

Understanding the truth helps avoid costly mistakes.

How to Choose the Right Workers Comp Insurance Policy

When selecting workers comp insurance:

- Compare multiple providers

- Review coverage limits

- Understand state compliance rules

- Check insurer reputation

- Ask about safety and claims support

A well-chosen policy protects both people and profits.

Frequently Asked Questions About Workers Comp Insurance

Is workers comp insurance mandatory?

In most states, yes. Requirements depend on employee count and industry.

Do part-time employees need coverage?

Often yes. Many states include part-time workers under workers comp insurance laws.

Can employees sue if they receive workers comp benefits?

Generally no, except in extreme cases like intentional harm.

How long do workers comp benefits last?

Duration depends on injury severity and state laws.

Does workers comp insurance cover remote employees?

Yes, if the injury occurs during work-related duties.

What happens if an employer doesn’t carry workers comp insurance?

Penalties may include fines, lawsuits, and criminal charges.

Conclusion

Workers comp insurance is not just a legal requirement—it is a vital investment in workforce protection and business stability. From covering medical expenses to safeguarding employers from lawsuits, this insurance plays a critical role in modern workplaces. Understanding how workers comp insurance works, what it covers, and how to manage costs empowers businesses to operate responsibly and confidently.

Whether you run a small startup or a large enterprise, having the right workers comp insurance ensures that when accidents happen—and they inevitably do—everyone is protected, supported, and able to recover.

More guides:

-

AmTrust Financial Services: Complete Company Guide 2026 (USA Insurance Leader)

AmTrust Financial Services Inc stands as a multinational specialty property and casualty insurance powerhouse headquartered in New York City, specializing in workers compensation, general liability,Read more -

AmTrust Business Insurance: Complete Coverage Guide for USA Companies (2026)

AmTrust business insurance delivers comprehensive protection for American companies across retail, hospitality, manufacturing, construction, and professional services. With A- AM Best financial rating and specializedRead more -

AmTrust General Liability Insurance for Small Business (2026 Complete USA Guide)

AmTrust general liability insurance for small business provides essential third-party protection against bodily injury, property damage, and advertising injury claims. With starting rates $30–$90/month forRead more